Volkswagen: M’sia an important market

Volkswagen Group executive vice-president (marketing and sales) Stefan Jacoby said, “There are two partners in Malaysia that we can look at but give us a little bit of time,” without elaborating.

Jacoby was speaking to journalists on a familiarisation trip here.

He said the group was already “behind time'' in achieving its strategy to enter into a joint venture with a company in South-East Asia to produce cars for the region.

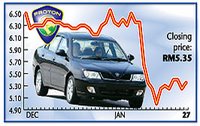

“We respect that Proton should be an independent enterprise. However, our idea of the Volkswagen AG and Proton joint venture was for VW to have management control and be the majority shareholder.

“We thought that this could help us secure our interest and strategic outlook for the Asean region.

“There was no rational reason given by Proton as to why they were not willing to give full management control except that it was related to national pride,” said Jacoby, who has been involved in the automobile industry for 20 years, half of which in Asia.

“Our success is based on the structure of an industrial holding and our holding company is our brand. The success of our brand is very much based on our independence to run the business of that brand,” he added.

Dr Christof Spathelf of Volkswagen AG's Project Management Proton/Manufacturing Overseas said the model implemented by Perodua, whereby 51% was owned by Toyota and 49% by Perodua, could be used as a model for Proton if the deal was agreed on.

There has been industry talk that a possible concern on the part of Proton will be the potential loss of many local suppliers.

“If Malaysia is an Asean hub for exporting cars, it will have to be a worldwide competitive supply industry in the country,” he said.

Jacoby said VW had planned to develop Proton just like it had done with Skoda in India, in which VW’s management had 100% control, and Skoda remained India’s national pride.

VW foresaw that Proton, being the biggest vehicle manufacturer in Malaysia with a whole value chain in the automotive industry, had its existing infrastructure to offer VW. But Proton would benefit from VW’s engineering and production technology, which would enable it to compete globally, he said.

“We would bring new investors into the country as well as provide employment,'' he added.

VW also wanted to strengthen its service and sales network and upgrade its supply chain, Jacoby said.

“We investigated the supplier infrastructure in Malaysia and believe that it can be developed to international standards.”

Volkswagen Group pre-sales and marketing director in Malaysia, Martina Berg, said the negotiations started one-and-a-half years ago and for the Germans, this had “taken too long.”

Jacoby said the 5% GDP growth in the Asean region was encouraging and in 2015, it is estimated that there would be 2.4 million cars on the road, one million more than last year.

Currently, VW’s office in Singapore focuses only on car imports and the group is looking for a partnership to grow the Asean market.

“We take Malaysia as an important market. We will start bringing in our cars in 2006 and 2007 and will continue investigations in Malaysia and Thailand for potential partners. However, that will be more in Malaysia than Thailand,” he added.

The Malaysian market is indeed important to VW.

The company sent a private jet to pick up Malaysian journalists, who were stranded in Copenhagen en route to Wolfsburg, as a result of a strike by pilots.